On the contrary, the apartment segment recorded a positive recovery in the third quarter of 2023.

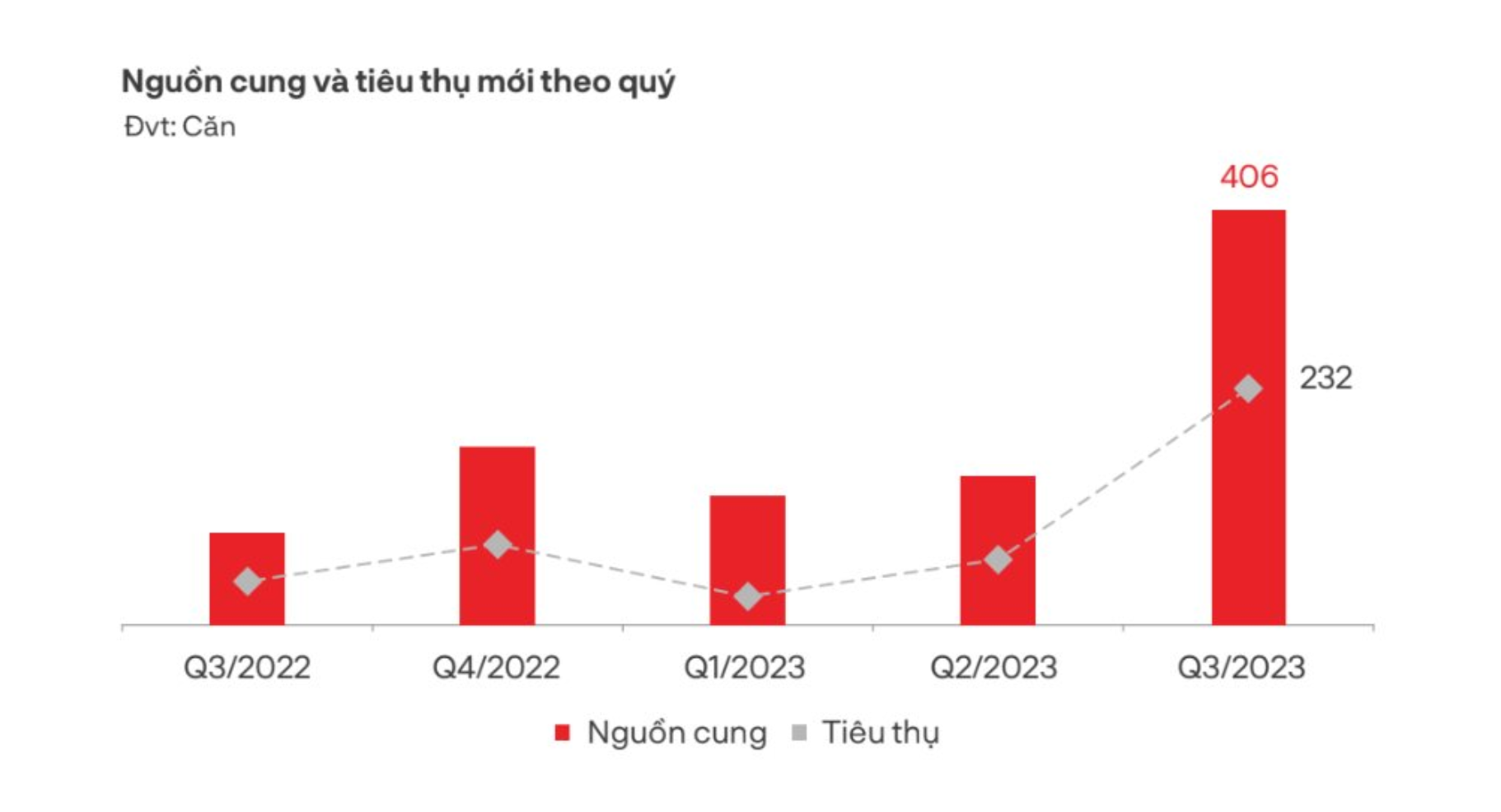

The apartment market recorded 5 projects in Da Nang opened for sale in the quarter, providing about 406 units to the market, 2.8 times more than the previous quarter and 4.5 times more than the same period in 2022. Projects opened for sale concentrated in Ngu Hanh Son District and Lien Chieu District of Da Nang. The overall market demand recorded a positive recovery, the ratio of consumption to new supply reached about 57%, equivalent to 232 units, 3.6 times higher than the second quarter of 2023 or 5.4 times higher than the same period last year. 2022. Most projects continue to postpone their opening dates to complete legal arrangements and wait for positive signals from the market at the end of the year.

Chart: Apartments segment Supply Source / Consumme

Apartments in Da Nang and surrounding areas increased both supply and demand in the third quarter of 2023.

Source: DKRA Group

The primary selling price level did not change much, some projects were adjusted to increase by 2% - 5% compared to the previous sale. Secondary liquidity improved compared to the first half of 2023 but remained at a low level, unlikely to change in the short term.

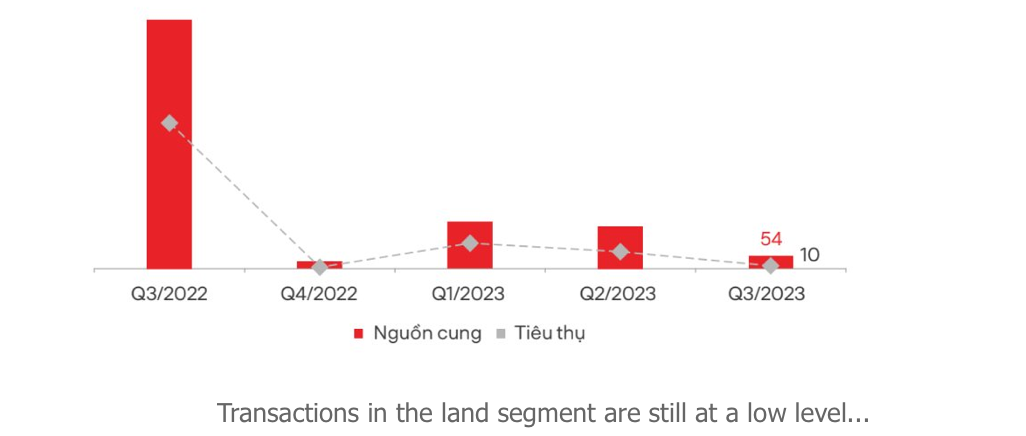

DKRA Group forecasts that the supply of land in Da Nang and surrounding areas at the end of the year will likely increase slightly compared to the third quarter of 2023, fluctuating around 180 - 220 plots, concentrated mainly in Quang Nam and Da Nang. . The Thua Thien Hue area continues to be scarce in new supply. The primary price level continues to trend sideways compared to previous sales openings. Preferential policies, discounts,... continue to be applied by investors to stimulate market demand.

In the apartment segment, new supply in the fourth quarter of 2023 may fluctuate at 300 - 500 units, concentrated mainly in Da Nang. The proportion of Level A and luxury apartment supply is expected to increase, mainly distributed in the Ngu Hanh Son District area. The primary selling price level continues to remain high under pressure from project development input costs, loan interest costs, etc. due to the prolonged project implementation period.